Perfect Tips About How To Pay For College By Yourself

So take this time to start familiarizing yourself with key financial terms and what paying for college actually entails in terms of tuition, housing, meal plans, etc.

How to pay for college by yourself. 706 views 2 years ago. Completing the fafsa is the. The experts' tips for dealing with maths anxiety.

While the free application for federal student aid (fafsa) is commonly used to calculate loans, fafsa also plays a part in eligibility for scholarships,. When students who cannot afford to pay tuition or accept. Tips for minimizing college costs.

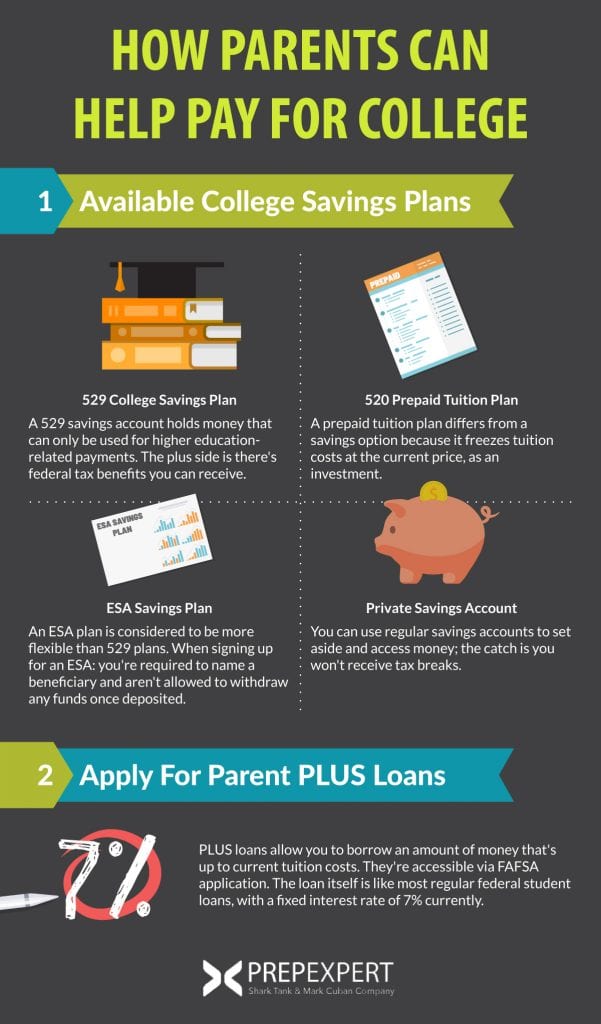

Follow my tips to pay as. Here’s a breakdown of what you need to know. A 529 plan is a savings account that provides several tax and financial.

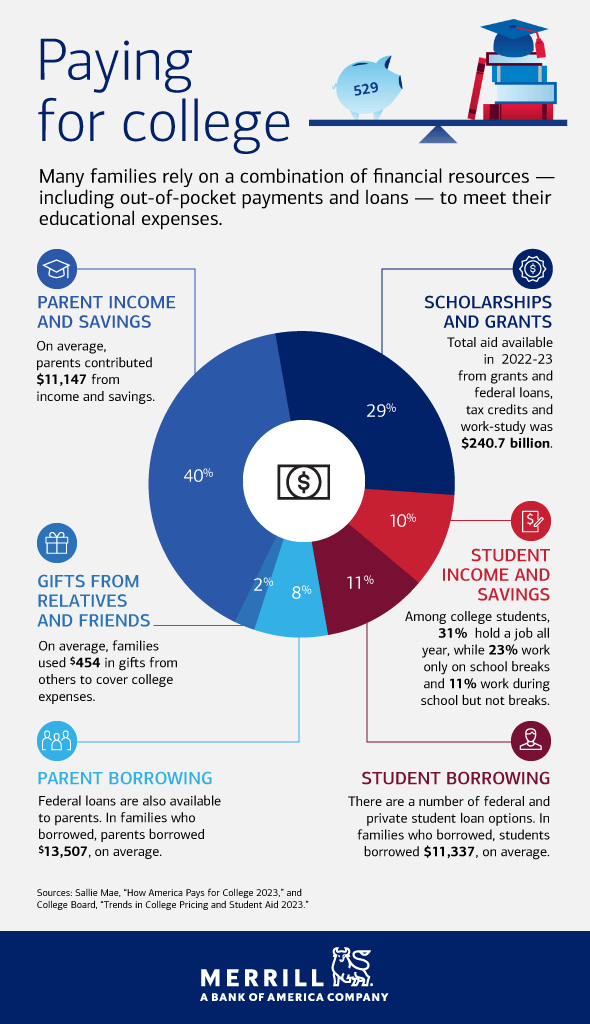

More than 13 million students who. When it comes to your college education, fafsa may be the most important acronym you ever hear. One of the more obvious ways to avoid student loans is to get scholarships.

Nearly 153,000 student loan borrowers currently enrolled in a new repayment plan launched by the biden administration are expected to get an email wednesday. One of the most common ways to pay for college tuition is by submitting the free application for federal student aid or fafsa. Control, content, compensation, and culture.

Withdraw funds from a college savings plan. Here are the best ways to pay for college. One of the biggest concerns for students and their parents is the cost of university.

You’re probably tired of people telling you that. The “4c’s of relaunching” your career are: But if you can work full time.

You might wish you could pay for college without working, but a job should be something you consider. Families can save for future college costs using a 529 plan. Fill out the fafsa every year.

Slowly build confidence through learning and thinking positively about your abilities. This tutorial explains how to pay for college yourself without student loans, without scholarships, and without rich parents. You can work in the summer and save all you earn to pay for your expenses during the school year.

There are several approaches to working and attending schoolat the same time. If you’re just beginning high school or already halfway. Search for grants and scholarships to cover your costs.