Looking Good Info About How To Check Your Income Tax Refund Status

How you file your return can affect when you get your refund.

How to check your income tax refund status. Your social security or individual taxpayer id number (itin) your filing status; Written by derek silva, cepf®. When you file your federal income tax return, you can check the status of your tax.

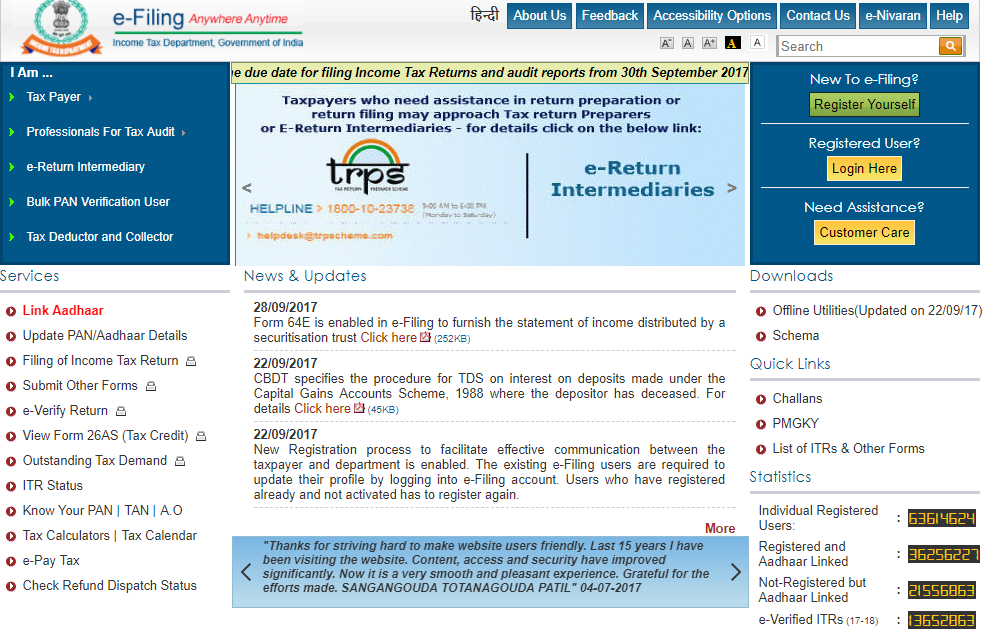

Use the irs where's my refund tool or the irs2go mobile app to check your refund online. You can call the cra’s tax information. Amended returns and those sent by mail can take up to.

9, the latest data available, the internal revenue service reported that the average refund was $1,741. The exact refund amount on your return; The exact whole dollar amount of your refund.

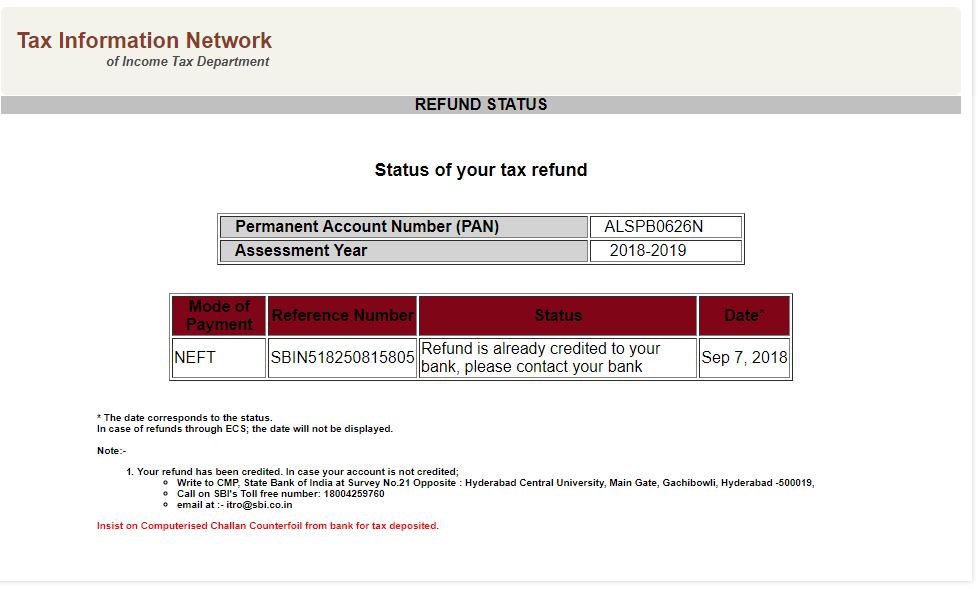

See if your federal or state tax return was. Information is updated once a day, overnight. Status of 'paid' refund, being.

Other ways to check your tax refund status. That's down 12.8% from an average of $1,997. Find your tax information in.

Check the status of your refund. Find out if your federal or state tax return was received. Checking your tax refund status online.

How to check your refund status: As of feb. You can also call the.

Go to the get refund status page on the irs website, enter your personal data then press submit. When to expect your refund. Table of contents.

Was your tax return received. Check the status of your tax refund. Check your refund.

The ohio department of taxation provides an online tool on the department's website that allows you to check the status of your income tax refund. Taxpayers can view status of refund 10 days after their refund has been sent by the assessing officer to the refund banker. Updated on december 14, 2023.